will my credit score go up if i finance a car

So in the beginning your score will be negatively impacted by the loan though its a temporary drop. While your credit score initially drops after buying a car with an auto loan it also gives you the chance to build credit in the long term.

Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer.

. The biggest reason why involves your. Ad We can help you get a car loan even with bad credit no credit repos or bankruptcy. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit.

If your current interest rate is high and your credit is good you may be able to lower your payments enough to keep your car by refinancing your loan at a lower interest rate. The good news is financing a car will build credit. The biggest piece of the pie is payment history making up 35 percent of your credit score.

If your auto loan is the only. The short answer. According to ExperianTM the average interest rate for a new car from a borrower with a deep subprime credit score ie a credit score between 300 and 500 in 2019 was.

Your approach to paying back the loan will decide longer-term credit score effects. In a nutshell the FICO credit scoring formula the most. Your score will increase as it satisfies all of the factors the.

Paying off your car loan early or on time will likely raise your credit score because the car debt is no longer on your report. For example if you have a thin credit file meaning you only have a few credit accounts a car loan will add to the number of accounts you have helping to build your credit. Paying off your loan in full will most likely not help your credit score and could potentially even hurt it.

Your score will likely go up. Payment history is 35 of your FICO credit score which is the most commonly used model. Opening any type of loan including an auto loan will typically result in a slight dip in your credit score.

Your payment history is the single most important factor in your credit score. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. Ad Choose the Right Amount to Borrow by Calculating Your Monthly Loan Payment.

Car loans are paid on a monthly basis giving you an opportunity every month. 100 Safe Secure Fast Free All Credit Welcome Apply Now. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer.

However without regular payments your score wont. Because car loans are installment loans and thus differ from. Check our financing tips and find cars for sale that fit your budget.

Ad Review 2022s Best Credit Repair. While FICO claims credit. But know that its only temporary and as you make payments in a timely.

When you take out an auto loan especially a bad credit car loan you gain the. As you make on-time loan payments an auto loan will improve your credit score. Fix Bad Credit Fast With Trusted Comparisons.

If you make numerous applications for car finance repeated credit checks can impact your score negatively. In fact both of the most common credit-scoring models FICO and VantageScore have credit card utilization as a primary factor in determining your credit scores. The impact of paying off your car loan could have a bigger influence on your credit score if you have a thin file which means a sparse credit history.

Paying your credit cards off can help your credit score particularly if payments lower your credit utilization ratio.

Does Financing A Car Build Credit

What Credit Score Do You Need To Get A Car Loan

Pay 500 Down For Auto Loans With 500 Credit Score Credit Down Loan Car Loans Private Party Bad Credit

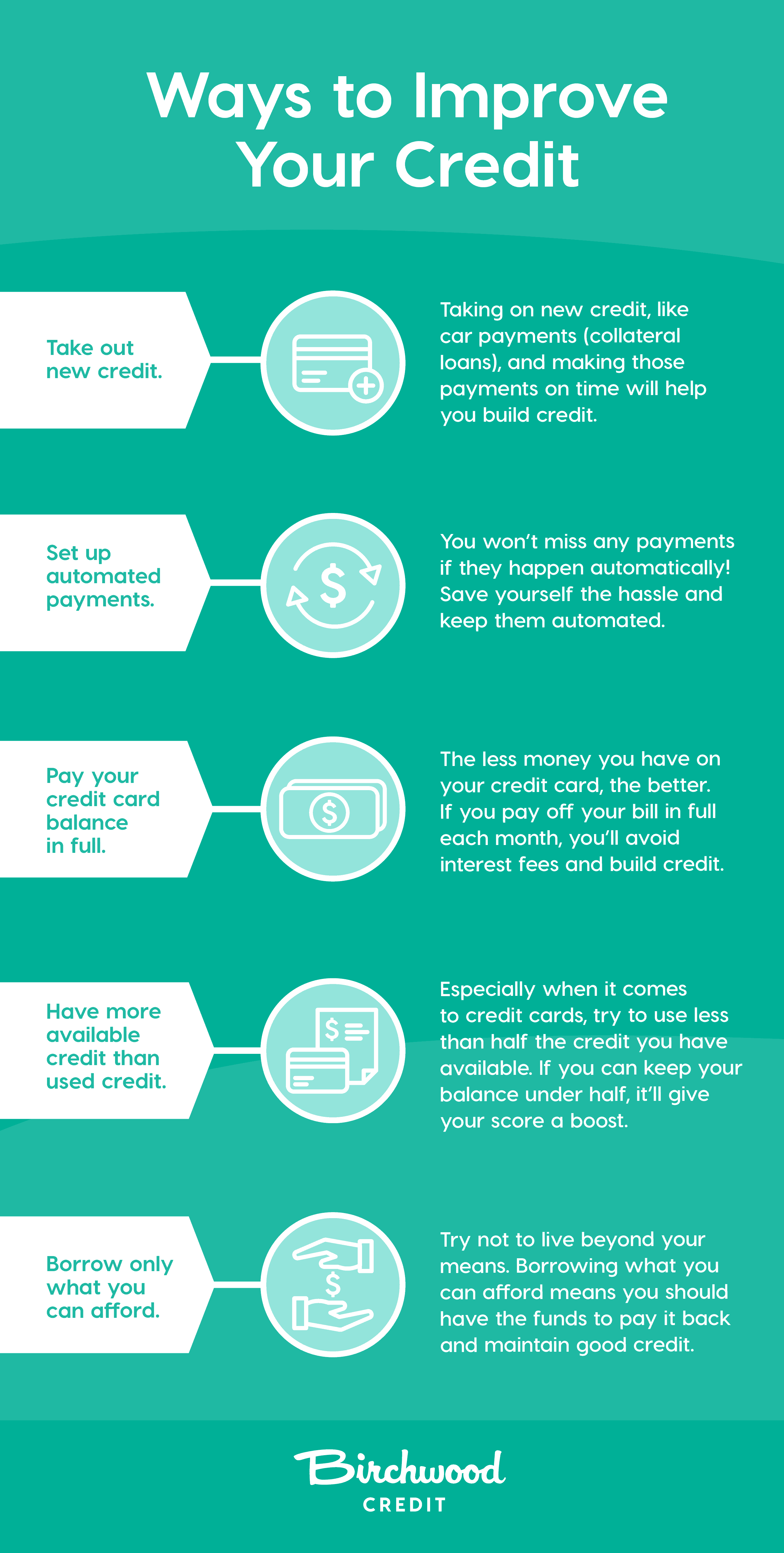

Let Us Help You Achieve A Perfect Credit Score Credit Score Improve Your Credit Score Ways To Build Credit

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Credit Score

Credit Score 101 Zblog The Zions Bank Blog Credit Score Good Credit Credit Repair

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Good Credit

What Makes Your Credit Score Go Up And Down Credit Score Fix Your Credit No Credit Loans

Credit Score Range What Is The Credit Score Range In Canada

0 Response to "will my credit score go up if i finance a car"

Post a Comment